Barclaycard has announced its involvement in piloting a new a payment card, in association with Deloitte and Visa Europe.

![]() As well as being a standard Visa Corporate card, this innovative new card enables Deloitte employees to remotely access their company IT system via a virtual private network (VPN). The card has a keypad and LCD screen embedded into it, to allow users to enter their PIN and generate a one-time use passcode. This passcode is then authenticated by Deloitte’s VPN. In addition, the card ensures that cardholders have the convenience of only having to carry their Corporate Barclaycard without the need to carry a separate security token or device. The technology that the card uses was developed in conjunction with EMUE Technologies.

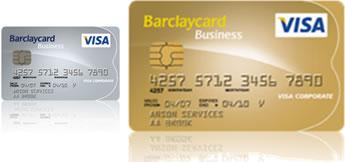

As well as being a standard Visa Corporate card, this innovative new card enables Deloitte employees to remotely access their company IT system via a virtual private network (VPN). The card has a keypad and LCD screen embedded into it, to allow users to enter their PIN and generate a one-time use passcode. This passcode is then authenticated by Deloitte’s VPN. In addition, the card ensures that cardholders have the convenience of only having to carry their Corporate Barclaycard without the need to carry a separate security token or device. The technology that the card uses was developed in conjunction with EMUE Technologies.

The Barclaycard pilot is the first corporate card pilot of the Visa Credit Card with one-time code functionality in Europe and is expected to reduce user costs substantially compared to using a separate token device for remote network access. In addition, Barclaycard’s proven capability will provide improved information on card usage with up to date transaction statements available online.

In addition to supporting remote network access, The Visa Corporate Barclaycard features other applications. It is compatible with Verified by Visa which could prevent card not present (CNP) fraud and identity theft associated with online banking, telephone authentication and other remote channels.

Barclaycard’s leading role in the piloting of this new card was recognised when it won the ‘Best use of innovation within Visa systems or services’ award at the recent Visa Europe Insights event.

The award highlighted Barclaycard’s commitment to using technology in an innovative way to bring additional benefits for its customers.

Neil Radley, Managing Director of Barclaycard Commercial, commented: “This product is an ideal solution for our corporate customers as it effectively combines two items in one; as well as being a standard Visa corporate card it incorporates a token which enables safe and secure virtual private network (VPN) access. We are delighted to be developing this innovative card with Visa Europe.”

Simon Owen, Senior Partner who leads the Information and Technology Risk practice at Deloitte, said: “The EMUE technology enabled Visa Corporate Barclaycard offers real benefits for card issuers based on our own experiences of providing staff with one-time code functionality for remote access. We estimate that we could save up to 65% per user over having a separate traditional token device.”

Sandra Alzetta, Senior Vice President for Innovation at Visa Europe, commented: “Innovation is a key factor in Visa Europe’s continued success and growth. We are continually working to make Visa the most secure and convenient choice for both corporate and consumer cards. By embedding a battery, PIN pad and LED screen in a payment card, we believe we are offering the most innovative card product in the marketplace.”

About BarclaycardÂ

Barclaycard, part of Barclays Global and Retail Commercial Banking division, is a leading global payment business which helps consumers, retailers and businesses to make and accept payments flexibly, and to access short-term credit when needed.

The company is one of the pioneers of new forms of payments and is at the forefront of developing viable contactless and mobile payment schemes for today and cutting edge forms of payment for the future. It also issues credit and charge cards to corporate customers and the UK Government. Barclaycard partners with a wide range of organisations across the globe to offer their customers or members payment options and credit.

In addition to the UK, Barclaycard operates in the United States, Europe, Africa and the Middle and Far East.

Via EPR Network

More Financial press releases

in September to 55 in October. Most significantly, this is the first rise since December last year – a sign that some form of economic recovery could be on the horizon, possibly as a result of the recent Government bank bailout scheme.

in September to 55 in October. Most significantly, this is the first rise since December last year – a sign that some form of economic recovery could be on the horizon, possibly as a result of the recent Government bank bailout scheme.