BUCHAREST, Romania, 13-May-2024 — /EPR FINANCIAL NEWS/ — Digi Communications N.V. (“Digi” or the “Company”), one of the leading European telecommunications companies, listed on the Bucharest Stock Exchange, would like to inform the market and its investors that today, 13 May 2024, the Board of Directors of the Company convenes the general shareholders meeting (the “GSM”) of the Company (Digi Communications N.V.), to be held on Tuesday, 25 June 2024 at 2.00 p.m. CET, at the offices of Freshfields Bruckhaus Deringer LLP (Amsterdam office), Strawinskylaan 10, 1077 XZ Amsterdam, The Netherlands.

The main topics for the GSM are the following:

- discussion and approval items on the 2023 Annual Report (including the annual report, the statutory financial statements – consolidated and stand-alone – and the auditor report);

- approval of distribution of a gross dividend of 1,25 RON per share; ex-date – 3 July 2024, the record date for the dividend – 4 July 2024, and the payment date starting with 22 July 2024;

- release from liability of the members of the Board of Directors;

- remuneration report for the year 2023 (advisory, non-binding vote);

- approval of the revised Remuneration Policy of the Board of Directors (voting item);

- appointment of the statutory auditor for the for the financial year ending December 31, 2024;

- designation of the Board of Directors as the competent body to repurchase own Class B Shares;

- appointment of Board members;

- approval of granting stock options to executive directors.

We kindly invite the market to visit the Company’s website at http://www.digi-communications.ro/en/general-share-holders (for English readers) and at http://www.digi-communications.ro/ro/aga (for Romanian readers) to review the documentation package for the GSM.

The above-mentioned sections from the Company’s website also contain the English and Romanian complete versions of the 2023 Annual Report, the 2023 Consolidated and Stand-alone Statutory Financial Statements of the Company, as well as the Independent Auditor’s Report.

The document named ‘Agenda and explanatory notes’ contains detailed descriptions regarding the items for the GSM.

Any shareholder interested in attending or voting at the GSM needs to follow the procedures set out in the articles of association of the Company (available at http://www.digi-communications.ro/en/corporate-governance) and on the ‘Convocation Notice’ available at http://www.digi-communications.ro/en/general-share-holders).

***

ANNUAL GENERAL MEETING OF DIGI COMMUNICATIONS N.V. (THE COMPANY) TO BE HELD ON TUESDAY, 25 JUNE 2024, AT 2:00 PM CET AT THE OFFICES OF FRESHFIELDS BRUCKHAUS DERINGER LLP (AMSTERDAM OFFICE), STRAWINSKYLAAN 10, 1077 XZ AMSTERDAM, THE NETHERLANDS

AGENDA

- Opening

- Annual Report 2023

- Board report 2023 (discussion item);

- Dividend Policy (discussion item);

- Adoption of the 2023 Annual Accounts (voting item);

- Distribution of dividend (voting item);

- Release from liability of the members of Board of Directors (voting item);

- Implementation of the Remuneration Policy and the Remuneration Report for the year 2023

- The Remuneration Report for the year 2023 (advisory, non-binding vote);

- Approval of the revised Remuneration Policy of the Board of Directors (voting item);

- Appointment of Statutory Auditor

Proposal to appoint KPMG N.V. as the statutory auditor of the Company for the financial year 2024 (voting item);

- Corporate governance structure and statement of compliance with the Dutch Corporate Governance Code (DCGC)

The Dutch Corporate Governance Code was updated in December 2022. In connection with its revision, applicable as of the reporting year 2023, the Dutch Corporate Governance Code Monitoring Committee recommends to discuss the Company’s compliance with the revised Code 2022 with its general meeting at the AGM in 2024 (discussion item).

- Designation of the Board of Directors as the competent body to repurchase own class B Shares

Designation of the Board of Directors as the competent body to repurchase class B shares (voting item);

- Appointment of the members of the Board of Directors

- Re-appointment of Mr. Serghei Bulgac as Executive Director of the Board of Directors (voting item);

- Re-appointment of Mr. Valentin Popoviciu as Executive Director of the Board of Directors (voting item);

- Re-appointment of Mr. Zoltan Teszari as Non-executive Director and President of the Board of Directors (voting item);

- Re-appointment of Mr. Marius Catalin Varzaru as Non-Executive Director and Vice-president of the Board of Directors (voting item);

- Re-appointment of Mr. Bogdan Ciobotaru as Non-Executive Director of the Board of Directors (voting item);

- Re-appointment of Mr. Emil Jugaru as Non-Executive Director of the Board of Directors (voting item);

- Appointment of Mr. Jose Manuel Arnaiz de Castro as Non-Executive Director of the Board of Directors (voting item).

- Approval of award of stock options to directors

Authorize the Board of Directors to decide upon the award of stock options to executive directors of the Company (voting item);

- Close of Meeting.

Agenda

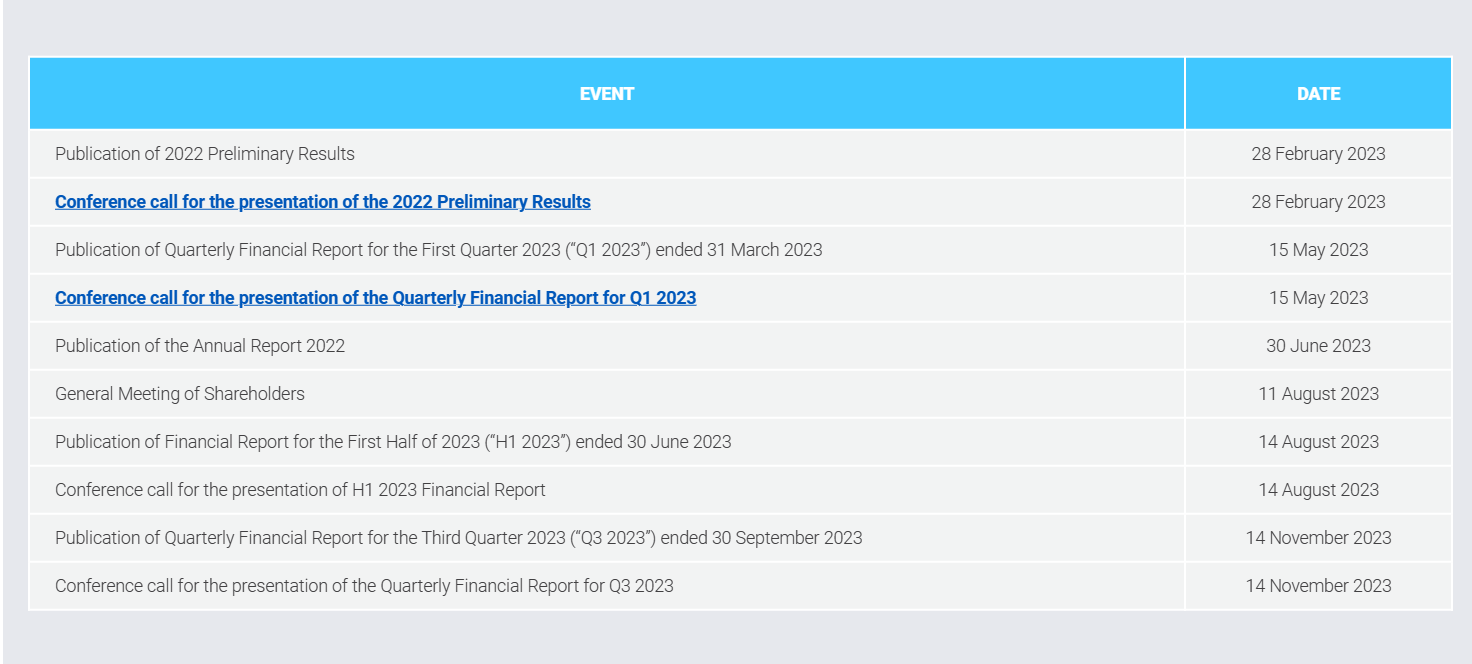

The agenda for the AGM and the explanatory notes thereto together with the Annual Report 2023 are available on the website of the Company (www.digi-communications.ro) from 13 May 2024 onwards and are, with effect from the same date, available for inspection and obtainable free of charge at the premises of the Company (tel. +40314006505 and address: 75 Dr. N. Staicovici Street, fourth floor, Bucharest, Romania).

Record Date

Shareholders (which for the purposes of this notice includes holders of rights of usufruct and pledgees with voting rights) are entitled to attend and vote at the AGM (either in person or by proxy) if they (i) are registered in one of the (sub)registers as described below on the 28th day prior to the AGM and therefore on Tuesday, 28 May 2024 (the Record Date) after all debit and credit entries have been handled and (ii) in addition have notified the Company of their intended attendance at the AGM in the manner mentioned below. The designated (sub)registers are the administration records of the Romanian Central Depository (Depozitarul Central S.A.), and the shareholders’ register of the Company.

Notification of Attendance

Class A shares: holders of registered class A shares (which for the purposes of this notice includes holders of rights of usufruct and pledgees with voting rights in respect of these shares) who wish to attend the AGM (either in person or by proxy) must notify the Company of their intended attendance, which notice, accompanied where applicable by written power of attorney (see below), must have been received by Mrs. Eliza Popa, the Company’s secretary at the address: 75 Dr. N. Staicovici Street, fourth floor, Bucharest, Romania and by e-mail digi.gsm@digi-communications.ro no later than by Tuesday, 18 June 2024, at 4.00 pm CET. Duly registered shareholders will receive a receipt confirmation supplied by the Company which together with a valid identification document will also serve as admission ticket for the AGM.

Class B shares: holders of class B shares (which for the purpose of this notice includes holders of rights of usufruct and pledgees with voting rights in respect of these shares) who wish to attend the AGM (either in person or by proxy) must notify the Company by registering via the E-vote by ING (https://evote.ingwb.com) no later than by Tuesday, 18 June 2024, at 4.00 pm CET. Duly registered shareholders will receive a receipt confirmation supplied by ING Bank N.V. which together with a valid identification document will also serve as admission ticket for the AGM.

Representation by Proxy

Class A shareholders: holders of registered class A shares (which for the purpose of this notice includes holders of rights of usufruct and pledgees with voting rights in respect of those shares) who will not participate in person to the meeting or be represented by their own legal representative may grant a proxy, on behalf of the relevant class A shareholder, to attend the AGM, to sign the attendance list, to speak and to cast a vote at that meeting on the voting items on the agenda in accordance with the voting instructions provided by the relevant holder, all with the right of substitution to:

- a third person; or

- Eliza Popa, secretary of the Company (address: 75 Dr. N. Staicovici Street, fourth floor, Bucharest, Romania).

The holder of shares A will notify the Company of an electronic copy of the proxy at the following e-mail address: digi.gsm@digi-communications.ro no later than by Tuesday, 18 June 2024, at 4.00 pm CET.

Class B shares: The holders of class B shares (which for the purposes of the AGM includes holders of rights of usufruct and pledgees with voting rights in respect of those shares) who will not participate to the meeting in person or be represented by their own legal representative can grant a proxy to:

- a third person (based on the Attendance notice and PoA to be obtained on the Company’s website on GSM documents); or

- Eliza Popa (to be obtained via E-vote by ING https://evote.ingwb.com),

who will be authorized to, on behalf of the relevant holder, with the right of substitution, to attend the AGM, to sign the attendance list, to speak and to cast a vote at that meeting on the voting items on the agenda in accordance with the voting instructions provided by the relevant holder.

The duly completed and executed power of attorney under which a third person is empowered to represent the class B shareholder at the AGM must be received by the Company for the attention of Mrs. Eliza Popa, Dr. N. Staicovici 75, fourth floor, Bucharest, Romania, or by e-mail: digi.gsm@digi-communications.ro or if the Company’s secretary is empowered, by registering the proxy via the E-vote by ING (https://evote.ingwb.com), no later than by Tuesday, 18 June 2024, at 4.00 pm CET.

E-voting Class B Shares

Only holders of class B shares (which for the purpose of this notice includes holders of rights of usufruct and pledgees with voting rights in respect of those shares) may also give voting instructions via https://evote.ingwb.com no later than by Tuesday, 18 June 2024 at 4.00 pm CET.

Identification

Persons entitled to attend the AGM (which includes persons granted with a proxy in the manner as described above) will be requested to identify themselves at the Registration Desk prior to admission to the AGM and are therefore requested to bring a valid identity document.

Issued capital and voting rights of the Company

At the day of this convocation, the Company has an issued share capital of EUR 6,810,042.52 consisting of 64,556,028 Class A Shares, each having a nominal value of EUR 0.10 and 35,443,972 Class B Shares, each share having a nominal value of EUR 0.01. 4,409,361 Class A Shares and 343,026 Class B Shares are held by the Company in its own share capital (in treasury). No votes may be cast for shares held by the Company in its own share capital. Therefore, the total number of voting rights at the day of this convocation amounts to 636,567,616.

About Digi Communications N.V.

We are an European leader in geographically-focused telecommunication solutions, based on the number of revenue generating units (“RGUs”) and a leading provider of telecommunication services in Romania and Spain, with a presence also in Italy, Portugal and Belgium.

SOURCE: EuropaWire