Barclaycard undertook a project to hire four semi-professional photographers in order to create a new set of imagery that moved away f r o m the traditional metaphors and financial services conventions.

Unusually for a big business, when Barclaycard realised it needed fresh creative images to sit with the new visual identity, and its customer promise, “One Step Ahead”, it decided to bypass the usual route of enlisting established corporate photographers. Instead the credit card and payment acquiring business set up a new programme to uncover some of the most talented semi-professional photographers and help them to get their career on the road.

The four photographers chosen – Australian Noel McLaughlin, Russian Natalia Urazmetova and fellow Brits Stuart Hendry and James Ellerker – were tasked with producing shots around a central theme of liberation that were warm and had a natural feel. The brief requested genuine situations with real people and with a clear focus on a key moment within the image.

Sharon Zimmerli, Senior Design and Identity Manager, Barclaycard said: “Our image content needs to remain optimistic and positive and must be intelligent and imaginative enough to engage our audience. By entrusting our brief to photographers who are inventive and talented, but not yet accustomed to the conventions of corporate photography, we were able to create fresh and engaging imagery to fit with our brand.”

The project was in many ways inspired by the success of social media photo sharing site flickr. When Barclaycard sourced notional images to demonstrate the style of photography which fit best with the new visual identity, most of the images that were deemed a neat fit were f r o m flickr.

About BarclaycardÂ

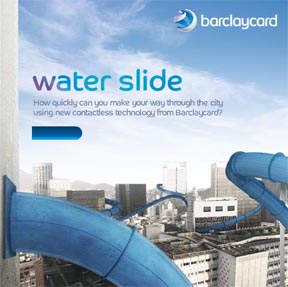

Barclaycard, part of Barclays Global and Retail Commercial Banking division, is a leading global payment business which helps consumers, retailers and businesses to make and accept payments flexibly, and to access short-term credit when needed. The company is one of the pioneers of new forms of payments and is at the forefront of developing viable contactless and mobile payment schemes for today and cutting edge forms of payment for the future. It also issues credit cards and charge cards to business banking customers and the UK Government. Barclaycard partners with a wide range of organisations across the globe to offer its customers or members payment options and credit. In addition to the UK, Barclaycard operates in the United States, Europe, Africa and the Middle and Far East.

Via EPR Network

More Financial press releases