Saxo Bank, the online trading and investment specialist, is addressing the problem of market information overload with its TradeMaker module to complement its trading platforms, as well as a new Trading floor website.

The information barriers of the past that limited trading to professional traders with a Bloomberg or a Reuter’s screen have long gone. The quantity of trading information and Forex news available to all types of traders on a home or business PC has increased to such an extent that now it is possible to trade not only stocks, but also Forex and more exotic instruments such as Futures and CFDs.

But while speed is vital when making trading decisions, speed without solid strategic insight won’t bring any advantages. The main problem is that as the cost of information has fallen, the volume has increased accordingly. Trying to find a way through this jungle of FX crosses, quotes and trades is sometimes a challenge even for the most experienced trader.

TradeMaker is a real-time trading idea generator that is part of Saxo Bank’s award winning trading platforms. It provides ten daily intra-day trading ideas on major currency crosses and CFDs including intuitive charts and interface, as well as one click pre-populated trade tickets or the ability to tailor the idea to personal trading strategies.

“Using the information and services provided by TradeMaker, we hope to be encouraging those traders that are looking to enter the market but need more direction,” said Patrick Mortensen, Global Head of Partner Marketing at Saxo Bank.

“We have already received feedback that tells us users actually feel more secure in their trading decisions, as TradeMaker enables them to better identify and manage the risks involved in the market,” said Patrick Mortensen.

The advent of the electronic trading platform has brought an end to the ‘open outcry’ of busy, noisy trading floors. As traders have retreated behind desks and screens, the shouting, signaling and pulling faces have disappeared. And with it has gone some of the human interaction that helped inform the markets.

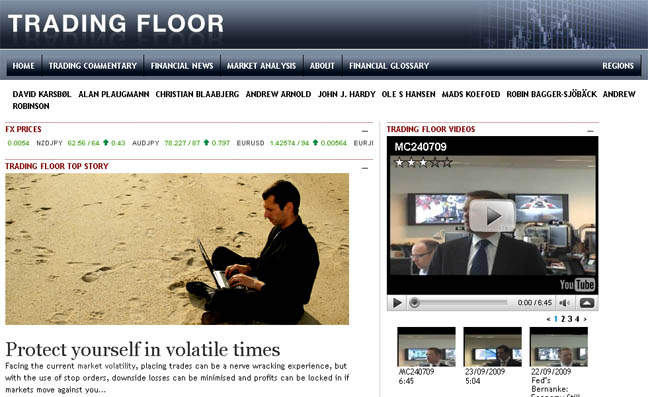

Trading Floor is an attempt by Saxo Bank to bring some of that noise back by getting the markets rubbing shoulders, dealing – and shouting. Trading Floor provides up to date, forex news and market place analysis.

The aim of the new Tradingfloor site is to bring market participants together through the web site. Saxo Bank provides the web site and the expertise of its strategists and analysts and those of its partners.

The Daily Trading Stance is the mainstay of Tradingfloor’s daily offering. It is the position that Saxo bank’s own strategists distribute to traders with a rundown of the main themes of the day in FX, equities, futures, and FX options.

The commentary is prepared by Saxo Bank’s Chief Economist David Karsbøl and Saxo Bank’s Equity Strategist Christian Tegllund Blaabjerg, with additional advice from Forex expert John hardy, who was named as one of the most influential people in Forex in 2008. Commodities expertise is provided by Ole S Hansen and Alan Plaughmann. Tradingfloor.com also has its own YouTube Trading Floor channel which is updated daily with the day’s trading information and delivered by David or Christian.

The speed of trading has picked up tremendously in recent years with the use of automated and semi-automated systems. But the systems are only as good as the information they receive. The key to success in online trading is to find reliable sources of solid tradable information.

About Trading Floor:

Trading Floor is run by Saxo Bank – a global investment bank specialising in online trading and investment across the international financial markets. Trading Floor provides up to date forex news and market place analysis.

Via EPR Network

More Financial press releases