The Southeast Private Equity Conference (SPEC) is seeking dynamic high growth companies in search of angel investors and venture capital to present their business opportunity at the acclaimed SPEC 2009 scheduled for April 14 and April 15 in Atlanta, GA.

Conference coordinator, Karen Rands, states “the market for angel investors and early stage venture  capital is on the rebound and SPEC is at the forefront in bringing these communities together to create an environment where innovative companies connect with capital, investors and resources. The response f r o m investors for early registrations to attend SPEC 2009 has been impressive and indicative of their optimism for an economic upswing.” Investors f r o m across the East coast and as far away as Detroit, Dallas and Silicon Valley have made plans to attend this particular conference for three very important reasons:

capital is on the rebound and SPEC is at the forefront in bringing these communities together to create an environment where innovative companies connect with capital, investors and resources. The response f r o m investors for early registrations to attend SPEC 2009 has been impressive and indicative of their optimism for an economic upswing.” Investors f r o m across the East coast and as far away as Detroit, Dallas and Silicon Valley have made plans to attend this particular conference for three very important reasons:

1) SPEC targets early stage and emerging growth companies that have viable business models so the valuations are still low enough to garner a significant multiple on their investment at exit.

2) The location for SPEC is a more intimate setting than most conferences held at big hotels so they can maximize the effectiveness of their time at the conference by making the strategic connections critical to their business objectives.

3) The timing of SPEC fits with busy schedules to make a two day trip with only one night stay over in Atlanta.

Companies interested in participating in this year’s event are encouraged to submit their proposals by March 15, 2009. Early Bird discount pricing savings for investors, strategic service providers, and entrepreneurs expires Feb 25, 2009. Special travel rates are available through Travelocity and Expedia to travel to Atlanta. Hotel information, application, accommodations, agenda and registration information can be found online at seprivateequity.org.

SPEC will showcase the most promising emerging growth and technology companies f r o m across the United States, providing these companies with unmatched exposure to a national audience of venture capitalists, accredited investors, investment bankers, fund managers, angel investors, corporate and private equity investors representing over $560 million in investment capital. The conference offers exclusive networking opportunities, an exhibition area, featured speakers, and investor and entrepreneur break-out sessions.

The conference is unique in bringing together early stage companies and capital sources while blending a tradeshow environment with deal flow presentations and entrepreneur and investor education. Held at the trendy 103 West in Buckhead, Georgia, SPEC 2009 creates an environment that is conducive for networking and deal making.

Investors are treated to the best in culinary creations and comfort as they mix and mingle with other investors and the CEOs of the hottest emerging growth companies in the Southeast. Investors will view unique investment opportunities to rebuild slumping portfolios and will have a direct impact on the economy by creating needed jobs with the growth of these early stage companies.

The recession had already begun when the inaugural Southeast Private Equity Conference kicked off in April 2008. Over 100 investors attended that event to preview 40 of the most exciting high growth companies of 2008. Many deals were initiated and millions of dollars were invested to help those companies act on their market opportunities. Angel Investor Michael Horton had this to say about SPEC 2008, “Congratulations on a superb job on SPEC — great organization, many interesting companies and an attendance that far exceeded my expectations.” To learn more about what investors and entrepreneurs experienced in 2008, view testimonials at seprivateequity.org/success.html.

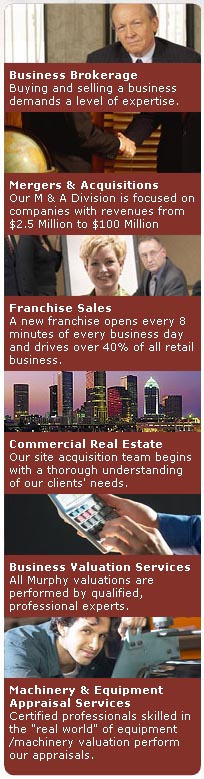

Atlanta is rapidly becoming the hotbed of innovation and capital formation in the Southeast. Three venture capital oriented forums are scheduled for 2009. The Southeast Private Equity Conference (SPEC) differs f r o m the larger conferences, SEVC and Venture Atlanta, in 4 ways that are important to both investors and early stage companies:

1) An intimate setting at a 103 West maximizes the connections made between investors and entrepreneurs.

2) The use of breakout sessions to educate both investors and entrepreneurs brings additional value to attendees.

3) The blend of formal venture deal presentations in the Innovative Company Showcase and the reverse capital marketplace set in the Capital Expo helps investors easily find the companies they want to talk with about investing.

4) With the Fast Pitch segment scheduled during the VIP reception in the Capital Expo, investors will get a highlight of each company and opportunity to identify those they want to spend more time with the following day following full presentations by selected companies in the Innovative Company Showcase.

Sponsors interested in reaching investors of all types and entrepreneurs of high growth potential companies should consider choosing a SPEC sponsorship level that fits their budget. SPEC offers a great value for sponsors looking to reach this target audience during a tight economic time. Information on sponsorship levels and benefits can be found at seprivateequity.org./sponsorship.html.

With investors looking for ways to rebuild their losses f r o m recent market fluctuations and entrepreneurs seeking capital to bring tremendous innovation and job growth opportunity to the market, the Southeast Private Equity Conference (SPEC) is poised to be a pivotal event to have profound impact on the market. Earlybird tickets are now on sale for this very important event at seprivateequity.org.

Via EPR Network

More Financial press releases

‘Pay monthly’ prepaid card customers will pay a monthly fee of £4.75 per month, but will not incur any UK transaction fees.*

‘Pay monthly’ prepaid card customers will pay a monthly fee of £4.75 per month, but will not incur any UK transaction fees.*