The call comes shortly after Tesco Insurance announced it was launching new levels of health cover in response to a customer survey asking for greater flexibility towards private medical insurance. The insurer revealed that it would be adding three new cover options to its list of health insurance products: Operations and Procedures, Consultations and Tests and Additional Therapies. New customers will also have the option of getting three months free when they sign up to Tesco Health Insurance.

Although figures from the Association of British Insurers indicate that the number of people covered by private health insurance is on the rise, with a 2.7 percent increase registered in 2008, Insurancewide believes that further measures can be taken to make medical cover more accessible to the general public.

Making UK health insurance policies more flexible

Since the UK has provided its population with free health care on the National Health Service for over half a century, many Brits tend to look upon health insurance as a luxury rather than a necessity. Yet with medical threats like swine flu making their way closer to home, and NHS waiting times showing no signs of getting shorter, many people have effectively come to consider private health insurance as a requirement and a valuable source of peace of mind.

However, despite this widening market, many health insurers continue to sell general medical insurance packages without giving customers much room to tailor their policy to their own requirements. For instance, a family of four may wish to have a policy weighted towards paediatric care, while a young, single man in his twenties may want to purchase a health insurance policy containing options for alternative therapies such as acupuncture and physiotherapy. Others – especially people who already have a life insurance policy in place – may want to pay less for medical insurance without accidental death cover.

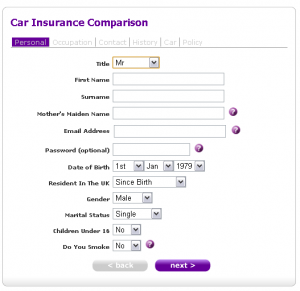

Insurancewide allows customers to compare health insurance policies across the UK market, making it simpler for users to request quotes and contrast policy benefits in order to choose a plan that’s right for them. However, to provide consumers with even more flexibility, the insurance comparison provider urges medical insurers to offer consumers greater choice to build policies to their own requirements, and offer policyholders insurance packages that are bespoke, comprehensive and affordable.

About Insurancewide

Insurancewide, also known as Insurancewide.com Services Limited, is an online insurance comparison website offering insurance comparison tools that allow users to search the market and procure the best insurance policies and quotes. Insurancewide was launched in August 1999 as the first insurance comparison website on the internet. The site also powered tools used on popular website Confused.com. Insurancewide is FSA regulated.

Via EPR Network

More Financial press releases