Term life insurance works by paying a predetermined amount of money to any beneficiary you choose if you pass away during the term of the policy. Term life insurance is the most popular type of life insurance policy because it is affordable, easy to understand, and simple to setup. It’s still important you understand how term life policies work before you go shopping for one so you know what questions to ask your life insurance agent.

Understanding the differences between whole and term life insurance is a good place to start. According to a recent article on InsuranceAgents.com, “Term life insurance is cheaper than permanent life insurance, it’s temporary but usually renewable, it has no cash value element and no policy loan provisions, and it usually can convert or transfer to a permanent life insurance.â€

If your financial needs aren’t permanent such as tax debt, a term life policy will benefit you the most since it is perfect for things such as paying off mortgages or student loans.

It’s important to remember that term life insurance starts off very affordably, but the costs do tend to increase over time. Sometimes these cost hikes are annual, but they can also be periodic throughout the course of the policy. Also, keep in mind term life insurance policies typically come in 15 or 30 year coverages and you will need to discuss with your agent which one is best for you. “When the term is up, so is the coverage. The insurance carrier will not pay the coverage if the insurer dies at any time (even a day) after the term,†according to the article.

If you don’t feel that term life insurance is the best choice for you, there are several other types like variable and whole. Discussing the available options with your life insurance agent is highly recommended on such an important financial decision like this.

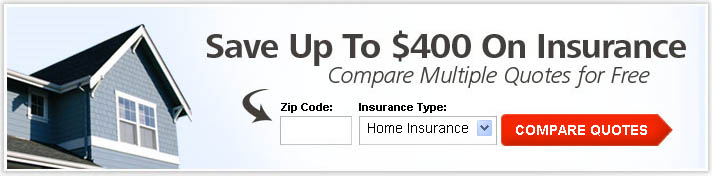

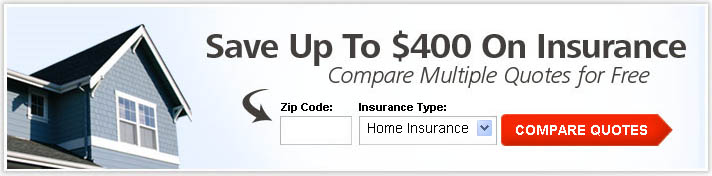

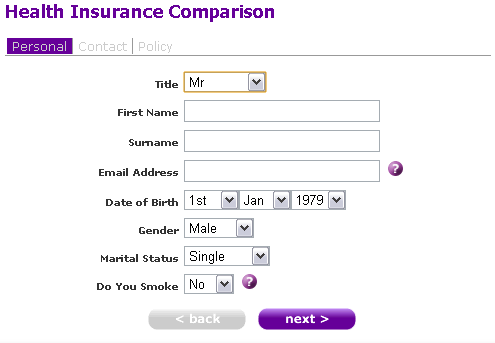

To find a local agent and compare up to 5Â life insurance quotes, try using a service like InsuranceAgents.com to find the lowest rate on a new policy.

Via EPR Network

More Financial press releases