The recent publication of The AA’s 2010 Insurance Premium Index has again highlighted the growing problem of increased car insurance costs for younger drivers. The Index estimated that insurance for 17-22 year old drivers increased by over 58% in 2010. This equated to a massive £829, increasing average premiums for this age group to over £2,250 – more than the cost of many first cars.

The team at Tiger.co.uk, a motor insurance comparison site, has highlighted another statistic about young drivers that also needs to be considered. The Motor Insurance Bureau (MIB) has estimated that 5% of motorists – over 1.2 million – are driving without insurance and 20% of these (243,000) are 17-20 year olds.

The same organisation estimates that the high level of uninsured driving has contributed towards the extraordinary level of inflation in car insurance premiums, adding about £30 to the cost of policies for legally insured drivers.

When viewed together these statistics lead to a worrying conclusion: as car insurance becomes increasingly unaffordable for younger drivers, so they may be increasingly tempted to drive without any insurance at all. This, in turn could lead to a rise in uninsured drivers’ compensation costs, again fuelling further increases in car insurance premiums.

A spokesperson for Tiger.co.uk commented: “The relationship between escalating insurance premiums and the growth of uninsured driving is inescapable. It could well lead to a “Catch 22†situation whereby having more uninsured drivers contributes to increased premiums causing drivers, particularly young drivers, to risk driving without insurance – which is of course a criminal offence. We would recommend that young drivers take the following steps to try and get cheap car insurance:

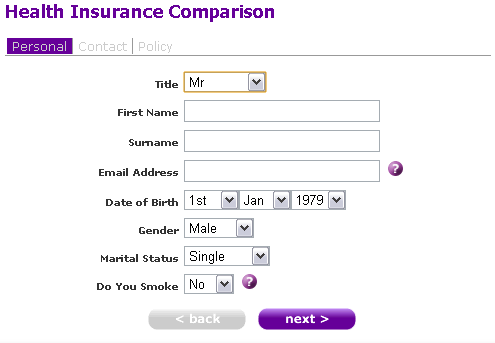

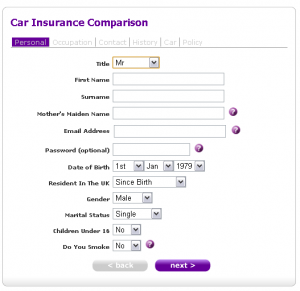

• Use car insurance comparison sites like Tiger.co.uk to make sure you get car insurance quotes and compare policies and get from a wide range of insurers.

• Consider taking the Pass Plus exam after passing your driving test – premiums can be reduced by up to 30%.*

• Have a look at ‘pay as you drive’ policies such as those offered by Insure The Box and Coverbox – both of which are available via Tiger.co.uk’s comparison service (the only car insurance comparison site to offer both of these insurance brands).

• Choose your car carefully – go for something in a low insurance group.

• Drive carefully and build your no claims discount as this can significantly reduce your premiums.â€

The spokesperson also reminded young drivers shopping for cheap car insurance:

“Don’t be tempted to get an older driver to “front†your policy for you. This practice of having an older more experienced driver as the main driver on a policy is illegal and can lead to insurance being void.â€

Via EPR Network

More Financial press releases